Agribusiness Confidence Index declines in third quarter

Petrol price is still a problem for the agricultural industry

September 7, 2018

Impact of politics and economy on tractor sales

September 13, 2018

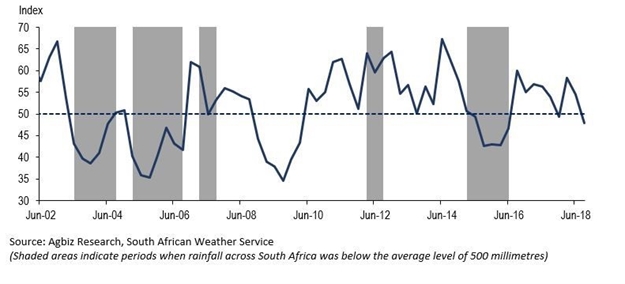

After being sustained at levels above the 50-point mark in the past two quarters, the Agbiz/IDC Agribusiness Confidence Index declined by 6 points to 48 in the third quarter of 2018.

This is the lowest level since the second quarter of 2016, which was a drought year. With the results now below the neutral 50-point mark, this essentially means that the agribusinesses are somewhat downbeat about business conditions in South Africa. The survey was conducted in August 2018 and comprised agribusinesses operating in all agricultural subsectors across South Africa.

The deterioration in confidence in the third quarter was mainly underpinned by five out of ten subindices that make up the overall Agbiz/IDC Agribusiness Confidence Index. These sub-indices include turnover, employment, capital investment, the volume of exports and economic growth.

Conversely, the subindices measuring net-operating income, the market share of businesses, general agricultural conditions, debtor provision for bad debt and financing costs subindices, improved somewhat.

Discussion of the subindices

Following a 14 index points decline to 64 in the second quarter of 2018, confidence regarding the turnover subindex deteriorated further to 62 points in the third quarter of this year. This is the lowest levels since the second quarter of 2017. The decline in confidence can mainly be explained by an annual decline in agricultural output, albeit being higher than average levels.

Interestingly, confidence in net-operating income subindex was roughly unchanged from the previous month at 59. This, however, was 4 points lower than the corresponding period last year – a decline that could also be explained by lower agricultural output compared to last year’s record levels.

After declining by 15 points in the second quarter from the previous one, sentiment regarding the market share of the business improved further by 6 points in the third quarter to 59. Most respondents, particularly the ones operating in the grain areas, cited improved operational efficiencies as a key boost of confidence at this point. The increased grain supplies, as this period coincided with the harvest, also could have lifted confidence regarding the market share of the business.

Confidence regarding employment in the agricultural sector declined further by 3 points from the second quarter to 53, which is the lowest level since the last quarter of 2016. This is unsurprising following a 0.4% q/q decline in agricultural employment in the second quarter of the year to 843 000 jobs. Furthermore, the above-mentioned decline in agricultural output led to a reduced activity in the fields, which potentially limited labour participation in some areas.

The perceptions regarding capital investments confidence declined by 14 points in the third quarter of 2018 to 50. This is the lowest point since the fourth quarter of last year when the agribusinesses were despondent following the ANC’s resolution to table a policy proposal that could enable expropriation of land without compensation. Continued uncertainty regarding this policy proposal was again cited by respondents as one key factor behind the deterioration in confidence in capital investments.

Confidence perceptions

Confidence regarding export volumes subindex fell to 35 index points in the third quarter from 39 in the previous one – this is the lowest level since the third quarter of 2013. The decline is partly on the back of lower horticultural products output, as well as the decline in meat exports, particularly ostrich.

The perception regarding economic conditions weakened to 15 points from 50. This sharp pullback comes after this subindex had improved notably in recent quarters, reaching a seven-year high of 68 in Q1 at the height of the so-called “Ramaphoria”. However, evidence of continued economic underperformance including the recent poor GDP data for the first quarter of 2018 and other weak high-frequency data are likely to have adversely influenced respondents’ perceptions. The survey was largely completed before the release of the second quarter GDP data which placed South Africa in a technical recession.

The general agricultural conditions subindex improved by 8 points from the second quarter to 50. This followed improved rainfall in the Western Cape and other winter crop growing conditions. With that said, the prospects of an El Niño in the upcoming 2018/19 production season remain a key concern that could potentially trump this optimism in the next quarters.

The debtor provision for bad debt subindex deteriorated by 6 points from the first quarter to 44. This is largely underpinned by improved agricultural commodity prices, compared to the level seen in the second quarter of last year.

The financing costs subindex declined by 23 index points from the second quarter to 41 in the second quarter of this year. To some extent, this is in line with expectations that the South African Reserve Bank could keep its repurchase rate unchanged in the near term.

Concluding remarks

While the deterioration in confidence in the past would typically be underpinned by unfavourable weather conditions, this time around things are different. The agricultural conditions are fairly favourable across the country, the root of pessimism is thus lingering policy uncertainty and weak economic growth, among other aspects discussed above.

“In our view, the lack of clarity regarding the land reform policy proposal, particularly expropriation without compensation, remains a key risk that could potentially undermine investment and long-run growth prospects in the sector. Nonetheless, we have not seen evidence pointing to disinvestment yet. Farmers and agribusinesses are somewhat in a wait-and-see mode,” says Wandile Sihlobo, head of agribusiness research at the Agricultural Business Chamber.

Sourced : Bizcommunity